How do I Gather Vendor Invoices via CSV Upload?

Discovery's ability to gather invoices via CSV streamlines your invoice processing workflow and offers unique advantages for situations when you receive a spreadsheet in lieu of a PDF invoice.

Benefits of CSV uploads include:

Data Accuracy: CSV format ensures precise data entry, reducing errors associated with PDF extraction.

Faster Processing: Eliminate the need for OCR technology, speeding up invoice extraction.

To gather invoices via CSV upload, please follow the directions below.

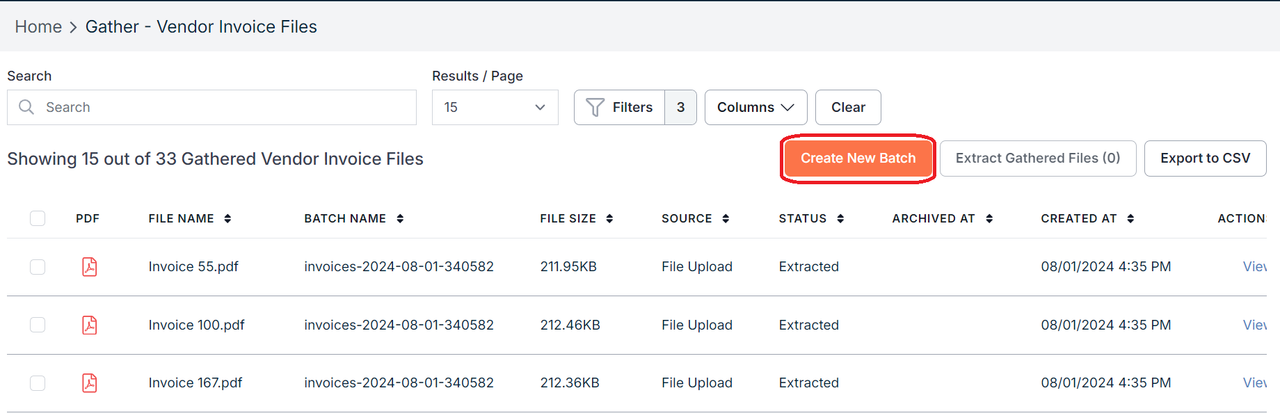

- Navigate to Gather.

- Click on the orange button that says Create New Batch.

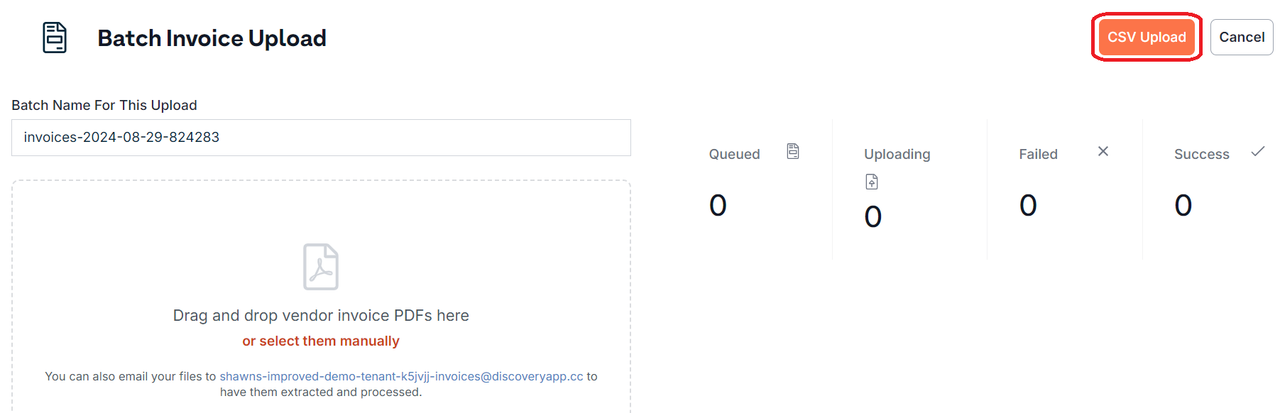

- Click on CSV Upload.

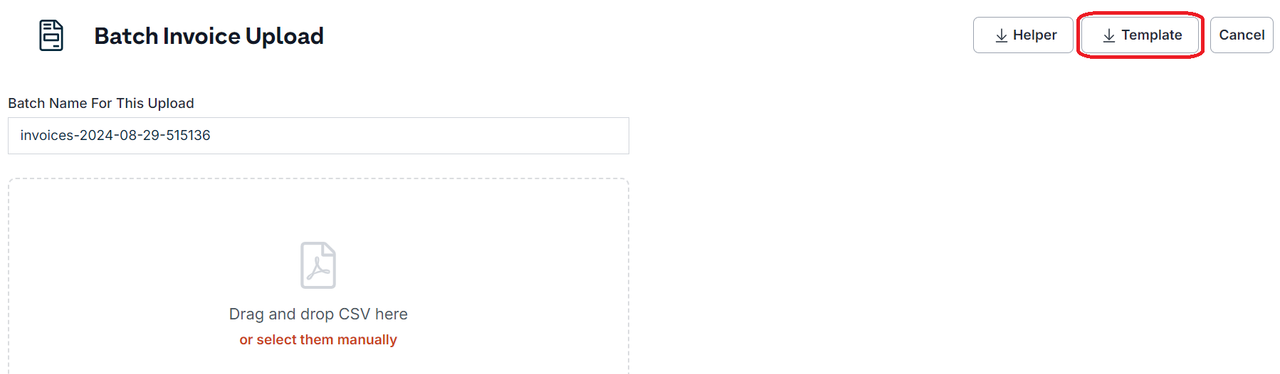

- Click on Template in the top right corner to download the CSV template file.

- Enter your invoice data into the provided template and save the CSV file as "gathered_vendor_invoice_files".

- You may either drag and drop your CSV into the dropbox or click the link to select your CSV manually.

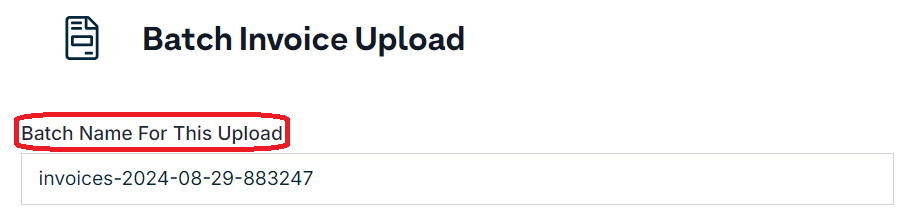

- Update the batch name if preferred.

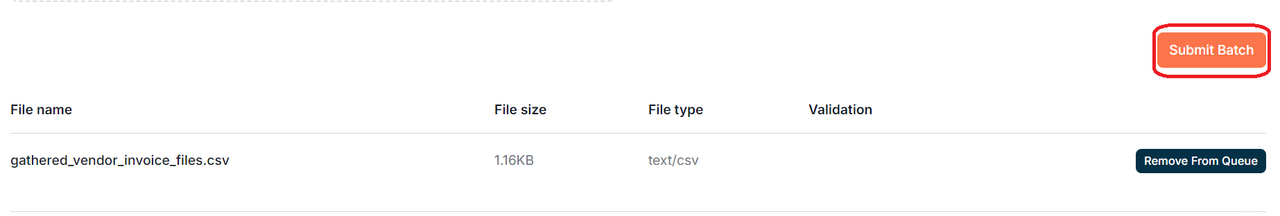

- Once you have selected your CSV file(s,) click on Submit Batch to upload the file(s.)

- Navigate to Gather.

- Click on the orange button that says Create New Batch.

- Click on CSV Upload.

- Click on Template in the top right corner to download the CSV upload template file.

- Enter your invoice data into the provided template and save the CSV file as "gathered_vendor_invoice_files".

- You may either drag and drop your CSV into the dropbox or click the link to select your CSV manually.

- Update the batch name if preferred.

- Once you have selected your CSV file(s), click on Submit Batch to upload the file(s).

NOTE: We have included a Helper file for your reference. This file can be accessed in the top right corner of the CSV Upload page. The Helper file includes an example of invoice data as well as lists of acceptable vendor fee names and vendor sales tax type names.

Import Template Fields

The provided Upload template file (gathered_vendor_invoice_files.csv) needs to retain all fields (columns), in no particular order, even if the fields are not required.

Required Fields

The following fields are required to successfully generate an OCR invoice.

- invoice_number

- line_item_amount | Must be provided as an integer (without dollar sign.) Amounts must be entered in pennies.

- Ex: - $75.00 must be entered as 7500

- line_item_description

Optional Fields With Other Requirements

The following fields are not required, but if entered, must meet the required criteria.

- line_item_type | Must be a valid type

- line_item_vendor_fee_name | Must be a valid vendor fee name

- line_item_vendor_sales_tax_type_name | Must be a valid vendor sales tax type name

- date fields | These can take in a single date or 2 dates. Examples: 04/01/2021, 04/01/2021 - 04/30/2021.

- invoice_date

- invoice_due_date

- invoice_service_date

- line_item_date

- amount fields | Must be provided as an integer (without dollar sign.) Amounts must be entered in pennies (Ex: - $75.00 must be entered as 7500.)

- invoice_subtotal

- invoice_total

- invoice_previous_unpaid_balance

- line_item_unit_price

Optional Fields

The following fields are optional and do not require data for each each invoice.

- invoice_customer_address

- invoice_customer_address_recipient

- invoice_customer_name

- invoice_purchase_order

- invoice_service_address

- invoice_service_address_recipient

- invoice_vendor_name

- invoice_vendor_address

- invoice_vendor_address_recipient

- line_item_quantity | Must be provided as a number.

- line_item_service_description

- line_item_service_address

- line_item_product_code

- line_item_reference_number

- line_item_subaccount_number

If you have additional questions or need more in depth information, please feel free to send us a message using the help beacon in the lower right-hand corner.